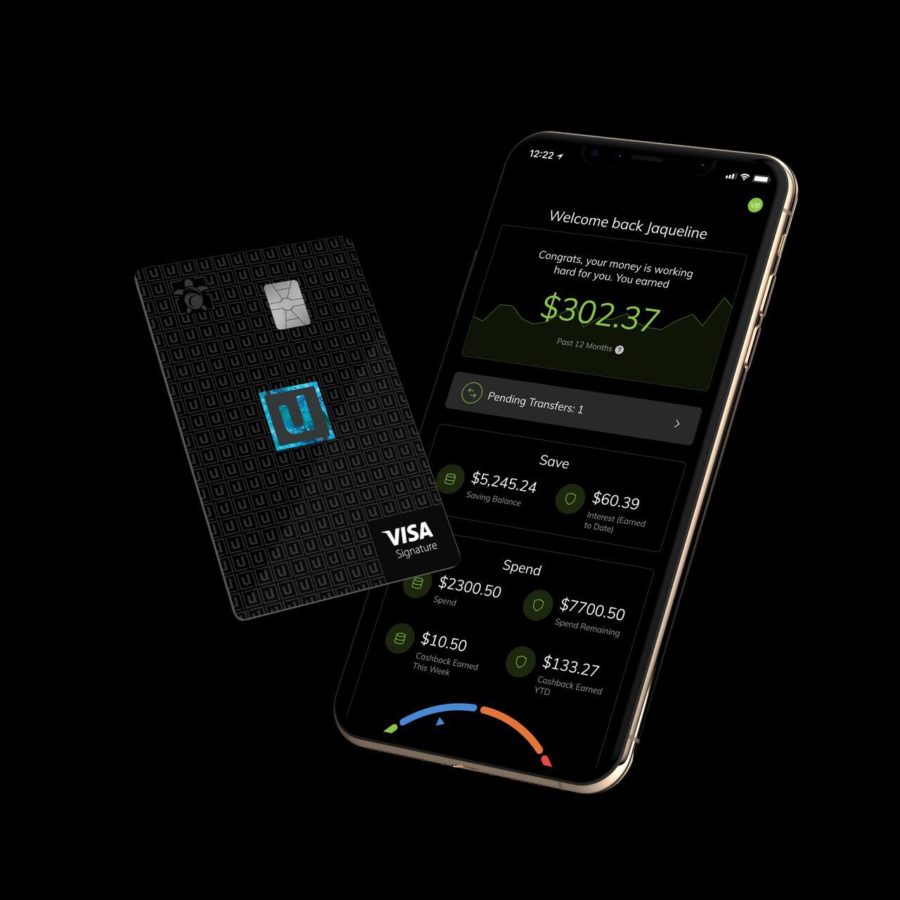

Unifimoney Fintech App Update

The fintech app Unifimoney has been updated. This fintech’s goal is to become a superapp where you can manage several types of investments. Now the superapp is taking shape. The last time I wrote about this app, it was when the startup announced plans for cryptocurrency and precious metals trading. These services are now available through Unifimoney’s partners, Gemini and GBI. And Unifimoney just added another financial service, next day bank account transfers, that I don’t remember seeing in the original roadmap. That service is provided by the fintech Astra. So I’m reviewing these new features.

The Cryptocurrency Trading Feature

Gemini’s a crypto brokerage in New York. It’s run by the Winkelvoss brothers, who originally came up with the idea for Facebook. They later sued Facebook founder Mark Zuckerberg and claimed that he stole their idea. After they reached a $65 million settlement with Facebook, they used the settlement money to invest in cryptocurrency and became billionaires. They’ve owned cryptocurrency since the early days of Bitcoin and they founded the Gemini brokerage in 2014.

So Gemini is a reputable fintech brokerage that’s regulated in New York State and overseen by state regulators. That doesn’t mean it’s safe to invest in cryptocurrency because this is a very volatile asset, but the brokerage risk is low here. The Winkelvoss brothers are long-term investors and they want their brokerage to succeed.

And because the Unifimoney app is integrated with the Gemini software, all of the cryptocurrencies supported by the Gemini platform are available on the Unifimoney app. This means that you can use Unifimoney to buy Dogecoins, as well as other cryptocurrencies such as Litecoin and Bitcoin Cash. The Unifimoney app allows you to trade 33 different cryptocurrencies. It doesn’t support Cardano or Ripple though.

Gemini also offers a feature called Gemini Earn that allows you to loan out the coins in your brokerage account. Unifimoney doesn’t currently offer this feature but it’s worth knowing about anyway because it may be added later. The interest rates on the Gemini Earn loans depend on the cryptocurrency that’s selected. Borrowers may pay anywhere between 2 and 7 percent interest depending on which coin they’re borrowing. Gemini Earn is not staking. This feature allows you to make unsecured loans and exposes the lender to additional risks.

The Precious Metal Trading Feature

Precious metals trading on the Unifimoney app is provided by GBI, or Bullion International. The Unifimoney app currently supports fractional gold, silver, and platinum trading. The GBI platform also supports palladium trading but that isn’t currently available in the Unifimoney app. Once again, you can invest by deciding how many ounces of precious metal you want to buy or you can select a certain amount of dollars to invest in precious metals.

GBI is a precious metals brokerage that physically stores precious metals in several vaults around the world. The metals in these vaults are insured against losses and protected by professional security agencies. Many other institutional asset managers also use the GBI platform to offer precious metals investment options to their clients. So GBI is also a reputable institution.

Next Day Bank Transfer Feature

Once again, I don’t remember seeing this feature in the original roadmap for Unifimoney. Astra is a fintech that uses open banking APIs to manage transfers between bank accounts. The Astra software allows customers to schedule future money transfers or set up rules such as automatically sending money to a bank account when its balance gets low. These are automated clearinghouse (ACH) transfers, not credit or debit card purchases, so there are no transfer fees. Additionally, you can transfer money to any other bank account using the Astra service if you know the recipient’s email address. You don’t need their other bank account details.

But it appears that Unifimoney’s service is even better than the standard Astra service. ACH transfers don’t clear instantly and may take several days to clear. But Unifimoney is saying that transfers will clear on the next business day right now, and in the future they will clear on the same business day. This indicates that Unifimoney may be making interest-free, short-term loans to its customers to provide this feature.

Astra’s service is similar to Zelle, the peer-to-peer money transfer service that banks offer to their customers. But while Zelle is focused on ease of use, Astra is focused on automation. The fintech startup describes automated financial services using a classification system similar to the one for self-driving cars. The goal isn’t just to make an app that supports instant cash transfers, it’s to make an app that can move money to and from any financial services account automatically to maximize returns.

Automated Money Management May Be the Best New Unifimoney Feature

Precious metals and cryptocurrencies provide diversification, but trading them is risky. Investors may lose money by trading these assets if they don’t know what they’re doing. So the Astra feature may be the most useful one for less sophisticated investors. And yes, I used the Unifimoney app to buy a small amount of Ethereum just before the cryptocurrency lost nearly half of its value, in case you’re wondering.

It might be easier to explain what Astra does by bringing up another Unifimoney feature, its sweep account. Unifimoney’s main deposit account pays 0.20 percent interest right now, which is higher than savings account interest rates at major banks. That’s possible because the Unifimoney deposit account is a sweep account.

With sweep accounts, the bank automatically moves your money from a checking account to an interest-paying account, such as a money-market account, at night and then moves it back in the morning. In this case, the bank that offers the sweep accounts is Unifimoney’s partner bank UMB.

Astra’s building software that supports other types of automated money transfers. Its software could help you earn more interest, pay bills on time, and reduce money transfer fees, among other things. It’s not just about providing next-day money transfers, it’s about automation. And by adding an automated personal finance service, Unifimoney has become even more competitive with other banks and neobanks.