Axie Infinity – Why the SLP Price Drop Is No Reason to Panic

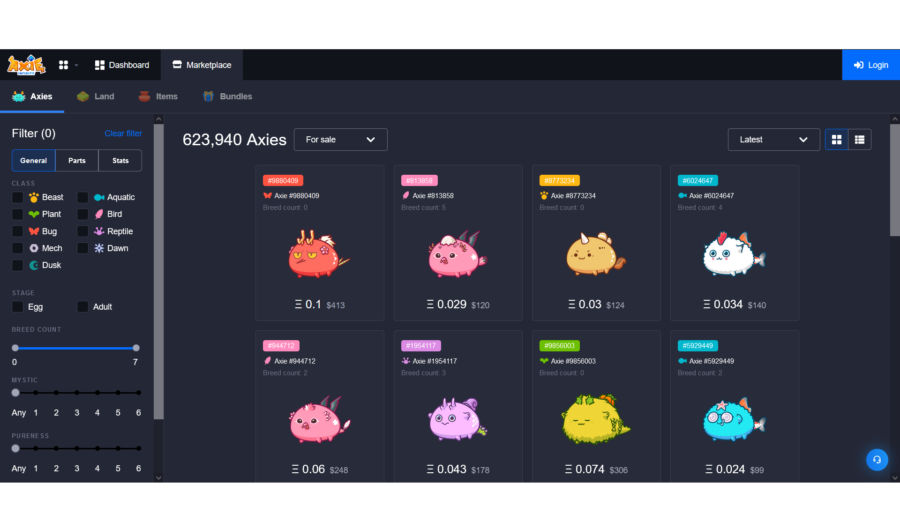

Over the last month, the in-game cryptocurrency smooth love potions (SLP) has lost half of its value. SLP was worth $.083 in early November and now the price has dropped to $0.039. As a result, lots of players are unhappy right now. Scholars who were playing Axie Infinity instead of working low-paying jobs in the Philippines have had their incomes cut in half. And as for managers, their axies are now worth a lot less. Axies that were selling for $300 a month ago can now be purchased for around $150 in the marketplace. Here is why I’m not worried.

The Standard Bull Case

The standard bull case is that when the land update gets released, there will be other uses for SLP besides breeding axies. At least that’s the developers’ argument, and it is likely to be true. Right now, you can only use SLP to breed axies, so if there are enough axies in the marketplace with the right cards to satisfy all of the current Axie Infinity players, there’s no longer a use for SLP. The cryptocurrency would only gain value if new players entered the game, which is why some people think Axie Infinity is a ponzi scheme.

You could make similar arguments about any type of collectible, including comic books, baseball cards, and Magic the Gathering cards. These collectibles are worth what other people are willing to pay for them and they don’t actually generate cash flow directly, unlike the axies in Axie Infinity. Collectibles like Beanie Babies only rise in price if other buyers will pay more money for them.

Axies, unlike other non-fungible tokens (NFTs), generate income. But to make that income keep its value, the game developers will need to come up with a way to use up the excess SLP. And it’s likely that the land update will include a feature like that. But I also have another argument about why I don’t think it’s over for Axie Infinity just yet.

Startup Founders and Axie Scholars

When you become the manager of an axie scholar, you’re loaning them your assets so they can use them to earn money. You purchase the axies and assume the risk that their value will drop. The scholar doesn’t take on any risk in this area. But the scholar is responsible for playing PvE adventures and PvP matches and earning SLP by doing that. And the scholar might not succeed. If their ELO drops below 800 and they can’t earn any SLP, the manager might take back the axies and assign them to a different scholar.

The founders of Sky Mavis are in the same situation, but on a much larger scale. In October, venture capital firms invested $152 million in Sky Mavis during a Series B funding round. Now, Sky Mavis will have to satisfy the metrics, also known as key performance indicators (KPIs), set by the venture capital firms. The venture capital investors want to see more players signing up for Axie Infinity and they would also like to see current players logging in every day.

And if Sky Mavis doesn’t achieve those goals, the venture capital investors can do the same thing that an Axie Infinity manager with an underperforming scholar would do. The venture capital investors will tell their representatives on the Sky Mavis board of directors to replace the founders with new managers who they expect to do a better job. This process regularly occurs at startups that don’t meet investors’ performance expectations. And activist hedge funds can also replace the CEO of a corporation if its stock price is falling and use their board seats to appoint a new CEO.

Conclusion

My argument is that if the price of SLP drops too low, current Axie Infinity players will play the game less frequently and may even stop playing the game. Meanwhile, new players will be less likely to sign up and buy axies. That will cause the metrics that the venture capital firms are monitoring to look worse. And if that happens, the venture capital investors may replace the management of Sky Mavis. So I don’t think that Sky Mavis will allow the price of SLP to drop too low because of that factor. And if it does happen, new Sky Mavis managers could turn around the business with policies that support a higher SLP price.

I see buying an axie for $152 and loaning it to a scholar as basically the same thing as a venture capital firm investing $152 million in a startup. A startup investment is a much larger deal but its founders still have the same responsibility to earn money with the investor’s assets. And there is one silver lining to this cloud. I was able to buy axies for my scholar for less than what I paid for the axies that I’m using on my own account. And those axies also have better cards in my opinion.