The Startup That Cuts Payment Processing Fees

I recently interviewed Lorde Astor West (Astor), the founder of fintech startup Scratchware. This startup pioneered Surcharging-as-a-Service™ by making an app that can recover credit card processing fees at the checkout by passing them on to consumers who choose to charge. The app allows merchants who accept credit cards to pass on fees while complying with state regulations and credit card networks’ rules, a task that until Scratch has been impossible or difficult for the average merchant to accomplish. But that is just the beginning of Scratchware’s plans. This fintech startup plans to roll out even more services that could greatly reduce merchants’ payment processing costs.

Background of the Founder

Scratchware is one of many solutions created over the years by Astor, an Arizona native and software developer who got her start in custom Web application development right after the .dot com bust in 2003. Over the past, nearly two decades, she and her team have developed and deployed an impressive portfolio of over 500 custom modular Web apps including a rapid development framework and several platforms that span eCommerce, payments, healthcare, auction, and automotive while serving legal, government, and state organizations.

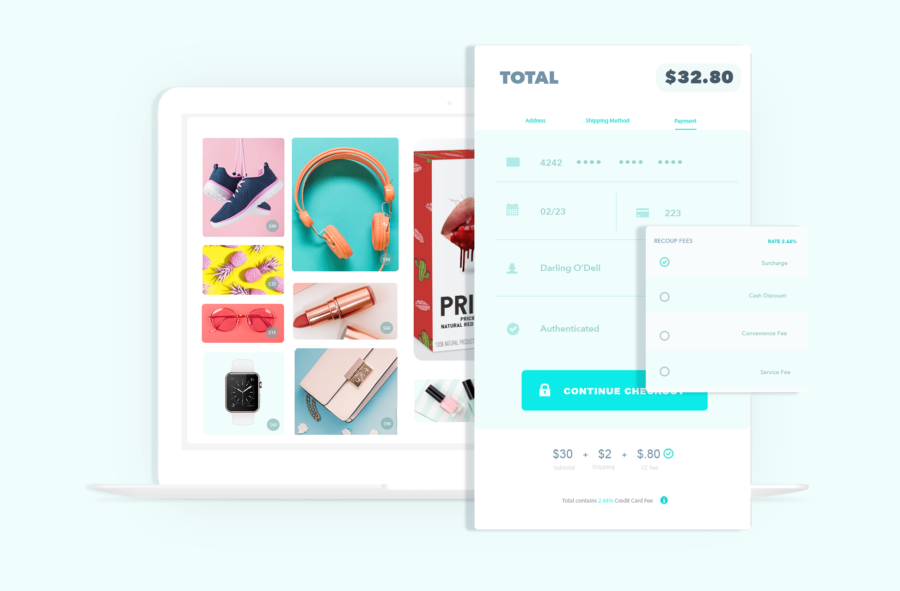

Astor’s current endeavor, Scratchware, is a revolutionary new type of software for the payments industry. The platform is 100% cloud native and was developed using the latest .NET 5 technology for the Azure cloud. Scratchware is unique because it is comprised of small building block applications with data security and portability at its core. Data portability gives merchants the option to bring all of their data together securely in one place without technical know-how. This design gives the merchant control over the use of the data, a stark departure from traditional payment platform architecture.

Giving Merchants More Control

Astor entered the fintech space to provide merchants with more choice and control. Platforms often make it difficult for customers to transfer their data to other apps, which helps them retain customers. If a customer leaves, they lose valuable data. It is bad enough if a business loses marketing data or customer data but losing access to its financial records is even worse. So, a platform can trap customers by locking up their data and then increase the fees it charges.

In 2018, Astor launched Scratch to prevent this from happening. The platform makes it possible for merchants to aggregate payments and transaction data from multiple platforms and share that data with trusted third parties. This made it easier for customers to switch between payment processors, banks, gateways, and other fintechs in the payments ecosystem.

Some payment processors offer artificially low prices at first, but then raise prices sharply once they have the customer’s data. For the most part, they will charge merchants various prices for transactions depending on the dollar amount and where the transaction originated. Through the Scratchware solution, merchants can now choose the best partners and route transactions to the best provider based on business rules the merchant chooses. This is called smart or intelligent routing and it can save a business between 15% and 30% in processing fees and false declines.

The Introduction of Surcharging-as-a-Service™

This is how Recoup Surcharging-as-a-Service™ got its start. In 2017 Astor was approached by a long time customer who curiously asked a question, “Is This Legal”. The customer was concerned after being approached by a sales person who was peddling a new “Credit Card Surcharge” service that would wipe out credit card processing fees. At the request of the customer, Astor and her team got to work investigating the terms of the potential opportunity.

During their investigation they discovered that while credit card surcharging was not illegal, the program that the customer was being pitched was not in compliance with the many rules and regulations required to run a successful credit card surcharging program. Seeing an opportunity, Astor and her team started to research surcharging in payments. They found that while many had attempted to create programs for this purpose, most had failed to adequately provide the necessary compliance aspects, and they also failed to provide the software components. It was at that moment Astor knew this was a major opportunity.

While credit card surcharges are often controversial, they can make a huge difference for a merchant. A credit card company may charge as much as a 4 percent fee on each transaction. If the merchant can make the customer pay that 4 percent fee, that has a major impact on the merchant’s margins. Many businesses have a profit margin below 4 percent. And by adding a surcharge on credit card transactions, the merchant can also maintain more affordable prices for less wealthy customers who use cash or debit cards.

More Payment Innovations

So, Astor created the Recoup app to provide Surcharging-as-a-Service™. Recoup would be just one of many payments innovations to be rolled out on the Scratchware platform. A few months back, Astor released another new feature that got a lot of attention. It reminded me of newsjacking, a marketing strategy where a company makes itself relevant to a current news story.

During the coronavirus pandemic, some businesses added surcharges to customers’ bills. These stores had to buy more cleaning products and could serve fewer customers in their stores, so they hiked prices to maintain their margins. Astor mentioned that Scratch could automatically add a coronavirus surcharge to a customer’s bill, and I commented on the post saying that a temporary surcharge might be better than a permanent price increase. The LinkedIn editors featured my comment in the sidebar, starting a long debate over whether coronavirus surcharges were appropriate. This event illustrates the benefits of modular design. This startup can quickly add new apps and services to its Scratch platform in response to current events.

This Is Just The Beginning

In recent months, I noticed that Scratchware had a new website and the Scratch platform was adding a lot more features. Astor was starting to raise a second round of investment and recruiting employees. So I asked her what was going on. It turns out that Scratch now offers a lot more than just a Surcharging-as-a-Service™ app. The platform is now a complete payments gateway with features like smart routing and multiple payment options. It offers supply chain finance solutions like cash discounting. And Scratchware also created a reseller program.